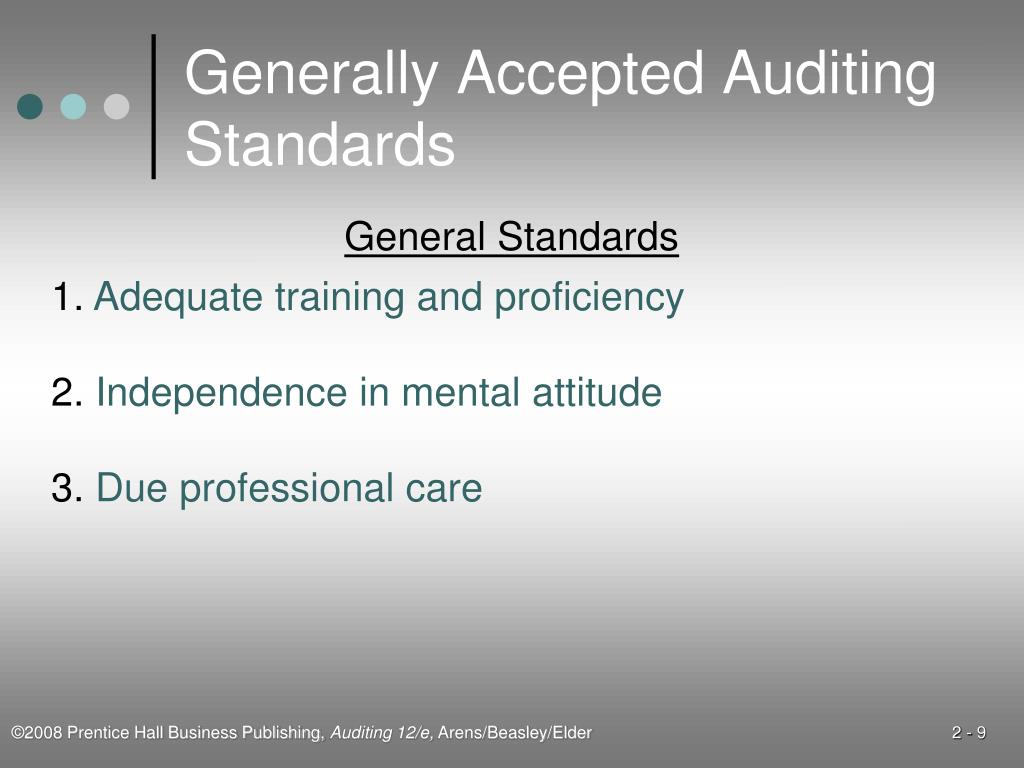

These examples illustrate how GAAS provide a framework for auditors to conduct their work in a professional and ethical manner, and to produce reports that are useful to stakeholders in making informed decisions about the company being audited. In performing an audit in accordance with generally accepted auditing standards, Government Auditing Standards, and the Uniform Guidance, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Reporting: Auditors must prepare a report that accurately reflects their findings and conclusions, and that complies with all relevant reporting requirements.Evidence: Auditors must gather sufficient and appropriate evidence to support their findings and conclusions.Adequate planning and supervision: Auditors must plan their work and supervise their staff to ensure that the audit is conducted in a thorough and efficient manner.Independence: Auditors must be independent of the company being audited, meaning they have no financial or personal interest in the company's success or failure.These standards are used to ensure that audits are conducted with integrity, objectivity, and independence, and that the resulting reports are accurate and reliable.

A glossary of relevant terminology for each subjectĪ crucial resource for accountants and auditors who are looking for a comprehensive explanation of the information used on a daily basis, Wiley Practitioner’s Guide to GAAS 2022 is an invaluable resource written to save you time and simplify your compliance with professional standards.Generally Accepted Auditing Standards (GAAS) are guidelines established by the American Institute of Certified Public Accountants (AICPA) that outline the professional qualities an auditor must possess and the criteria for conducting an audit and preparing reports.

In addition, Wiley Practitioner’s Guide to GAAS 2022 provides readers with: GAAS is the most acknowledged set of rules and standards across the world of accounting and auditing.

#Generally accepted auditing standards how to

The Guide explains the standards clearly and accurately, providing explicit information on how to conduct your engagements efficiently, effectively, and properly-all in one resource. GAAS helps to ensure the accuracy, consistency, and verifiability of auditors' actions and reports.

0 kommentar(er)

0 kommentar(er)